Analysis of recent employment data for Massachusetts' professional, scientific, and technical services indicates that the sector's growth exceeded the national average in 2007 for the first time since the 2001 recession.

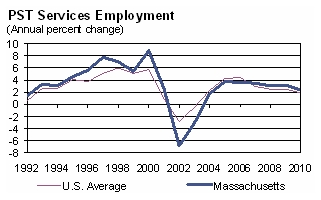

Over the past 15 years, the professional, scientific, and technical (PST) services sector has developed a significant presence in the Massachusetts economy because of its contributions to gross state product and to total employment. In addition, the sector has become a major source of payroll expansion in a maturing economy that tends to record only modest growth on a regular basis. Massachusetts' PST sector encompasses a variety of categories, including large concentrations of employment in legal services, accounting, engineering, computer systems design, consulting, and scientific research. Growth in the Bay State's scientific and technical services sector has been strong since the early 1990s, exceeding the national average from 1992 through 2001. Through much of the late 1990s, the gap between PST payroll growth in Massachusetts and the national average widened, largely because of rapidly accelerating growth in the state's computer systems and software sectors.

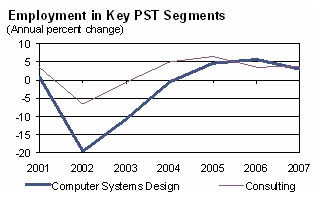

The 2001 recession reversed this momentum, though, resulting in a precipitous decline in the state's professional, scientific, and technical services payrolls—employment declined nearly 7% in 2002 and then another 3% the following year. The dramatic expansion in PST payrolls during the late 1990s and early 2000s relative to the nation gave the Bay State economy further to fall, which is exactly what happened when the bubble burst. The segments suffering the most damage were computer systems design and consulting services. The former saw double-digit job losses in 2002 that approached 20%, while the latter had a drop of more than 6% in that same year.

Both segments began to recover immediately after 2002, although they did not record positive jobs growth concurrently until 2005. Employment growth in the Bay State's overall PST sector lagged significantly behind gains at the national level for several years after the recession—a trend not broken until last year. According to recently released data for 2007, professional, scientific, and technical services employment growth in Massachusetts reached 3.5% last year, actually surpassing the 3.0% national average.

Just as computer systems and consulting losses were instrumental in dragging down overall PST employment during the years following the recession, these two segments have become equally important to the sector's recovery. Job gains in computer systems and consulting averaged 4.5% annually from 2005 through 2007. Although the rebound in overall PST employment has been helped by other segments, such as the consistently healthy scientific research and development segment, computer systems and consulting are the key reasons behind the resurgence in the state's skilled services economy.

We expect Massachusetts to maintain its prominence in professional, scientific, and technical services, with annual payroll gains of 2.8% during 2008–10 exceeding the 2.3% national average. Indeed, employment in biotechnology, consulting, computers, software, and engineering segments in particular, among others, will remain strong over the next few years—great news for a Massachusetts' economy that so often looks to its skilled services for significant sources of growth potential.