A Wilson Center report says Mexico's efforts to improve security in two states containing major oil and gas reserves may yield only short-term results and primarily benefit foreign business, while ignoring long-term efforts to improve citizen security.

The report (pdf) identified Veracruz and Tamaulipas as Mexico's most important states in terms of hydrocarbons development. Both states hold a major portion of the country's oil and gas deposits, including offshore oil sites in the Gulf of Mexico and shale gas formations similar to those already being successfully developed in the US. The states also house significant refining assets and some of Mexico's largest ports with direct sea routes to US energy hub Houston, Texas.

Following Mexico's energy reforms last August, a host of foreign firms have lined up to enter this newly opened market. Several firms have even revealed investment plans of a billion dollars or more, a recent Financial Times report said.

Veracruz and Tamaulipas are expected to receive much of this investment. On top of expected exploration investment, the Mexican government is seeking foreign funding for a major gas transportation network in Veracruz and several petrochemical plants. Meanwhile a series of anticipated hydrocarbons export projects are set to "put Tamaulipas on the map as Mexico’s most important energy state," the Wilson Center said.

However, Veracruz and Tamaulipas are also home to two of Mexico’s most powerful criminal organizations, the Zetas and their former progenitors in the Gulf Cartel. The two have been at war since 2010, making Veracruz and particularly Tamaulipas brutal places to live and operate a business. Tamaulipas, for instance, has the highest reported kidnapping rate in Mexico, the kidnapping capital of the world.

Both organizations have diversified their revenues by illegally siphoning hydrocarbon products from Pemex's sprawling network of oil and gas pipelines, and selling it domestically and abroad. Veracruz and Tamaulipas suffer the highest rate of siphoning incidents out of all Mexican states, the Wilson Center said.

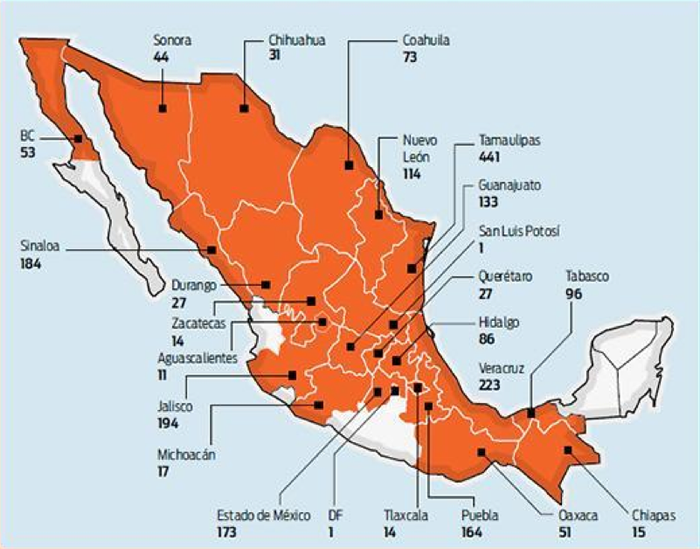

The problem goes beyond those states. Illegal siphoning incidents have grown steadily across Mexico from 296 registered in 2008 to 4,127 in 2014, Pemex executive Francisco Fernandez Lagos told El Universal in a recent interview. Pipeline breaches in 2014 cost Pemex over $1.3 billion in stolen product, repairs and clean up, Lagos added, calling the issue a "national security threat." (See registered breaches from 2013 from Wilson Report below)

As well-financed and technically-savvy organizations, the Zetas and Gulf Cartel are particularly suited to exploit the company’s weaknesses. Both organizations have the money and muscle to bribe or intimidate oil workers into revealing pipeline network vulnerabilities. Those same assets are used to dissuade local government and security personnel from interfering in oil theft operations. Criminals also reportedly operate extensive infrastructure including a fleet of tanker ships, oil trucks and cartel-controlled gas stations, the Wilson Center report said.

On top of stealing oil and gas, the Zetas and Gulf Cartel directly threaten oil company personnel with kidnapping and often extort "narco-rents" from companies operating in their areas of influence. The two groups have also been known to destroy oil and gas infrastructure and block transportation routes, attempting to force financial losses on each other's black market fuel operations.

The Zetas and Gulf Cartel's violent competition has indirect effects on Veracruz and Tamaulipas' oil and gas industry. The organizations regularly setup "narco-blockades" to capture and assassinate each other's members. These blockades have stopped oil trucks from reaching refineries and even shut down Tamaulipas' Altamira international airport for a period in 2014, the Wilson Center report said.

Eager to avoid incidents that could scare off foreign firms -- such as when Gulf Cartel members opened fire on a hotel housing employees of Swiss oil services firm Weatherford -- the Mexican government has announced new security plans in the two states.

In May, President Peña Nieto revealed Plan Tamaulipas, which will divided the state into four quadrants controlled by special army and navy units. The units are specifically directed to dismantle the criminal groups and their operations, and patrol against narco-blockades.

Under what’s called the "mando unico," or "single command," Tamaulipas' local police have been subsumed into a single state force. The state has also received 200 units of the recently formed Gendarmerie security force, whose directives include protecting strategic regional industries.

Similar efforts are underway in Veracruz, which also consolidated its police forces under mando unico. The new force is to receive about 8 million dollars in federal money to help police combat organized crime through better training and equipment. Additionally, the government will place some 1,800 Gendarmerie members in Veracruz "in the near-term," the Wilson Report said.

InSight Crime Analysis

The Wilson Center's prediction of short-term improvement but little lasting security progress in Veracruz and Tamaulipas is likely to prove prophetic. While Pena Peña Nieto has talked of new organized crime fighting methods, in practice his actions look very similar to the military-reliant strategies of his predecessor. Critics say the Gendarmerie, for instance, has more to do with politics than actual security reform.

In the end, no security measure focused on troop build-up addresses the issue of corruption within Pemex and local governments, or the perennial question of judicial reform and the need to strengthen the country’s penitentiaries.

"Corruption, bribes, and extortions remain an intractable problem for Pemex, and regional governments," the Wilson Center said.

What’s more, the Wilson Center report glosses over a key part of the criminal story: atomization. The Zetas and the Gulf Cartel are both going through a near constant restructuring due to their inter-cartel rivalry and the increasing presence of state forces in their areas of operation. The resulting fragmentation will make for even more dependence of these smaller, disperse criminal groups on low-tech crimes such as hydrocarbon theft and extortion.

The irony is that -- depending, of course, on the price of oil -- none of this may matter to oil investors. While multinational oil firms would prefer stable operating environments, they are no stranger to conflict zones and have experience in mitigating risks and violence, and are willing to pay a lot of money for private security. The prospect of supplying Mexico and neighboring energy-consuming giant the US will likely counter any security concerns, especially if prices return to pre-2014 levels.

"It will be bumpy for sure, but it will be absolutely fantastic," oil major BG Group executive Sami Iskander told the Financial Times.

Worse case scenario is that an increase in oil investment and production draws more criminals to the region. In that scenario, Veracruz and Tamaulipas citizens might bear the brunt of the crime without enjoying the benefits of the investment.