IN THE late 1990s and early 2000s central bankers in America and Europe had it easy. By raising or lowering the official interest rate, they could stimulate or dampen the economy at will. Rate changes would ripple fairly predictably through the banking system and bond markets, thereby affecting the price of borrowing across the economy. But following the 2008 crash, central banks were forced to pin their official rates to the floor. After five years of holding them near zero, monetary policymakers have become ever more reliant on “unconventional” measures.

Two policy tools in particular have become important. The first is making large-scale asset purchases. Since 2009 the Federal Reserve has been buying financial assets including government and corporate debt and pools of household mortgages. Over the same period the Bank of England has purchased £375 billion ($585 billion) of government bonds. The aim in both cases is to push prices up, thereby pushing down the yields, or interest rates, on these assets. This cuts the costs of finance across the economy.

If asset purchases target the cost of borrowing now, the second tool targets the rates that people expect to pay and receive in the future. In 2008 the Federal Reserve indicated that its policy rate, then below 0.2%, would be low “for some time”. In 2011 it was more explicit, saying that low rates would be “warranted” until mid-2013. In 2012 it went further still, committing to keep rates low until unemployment, currently 7.6%, falls below 6.5%.

The idea behind such “forward guidance”, a tactic since adopted by both the Bank of England and the European Central Bank (ECB), is that anyone considering a loan needs to take into account both the rate of interest today and the likely rates in the future. If central banks can make a credible commitment to keep rates in the future down, the expected payment on floating-rate mortgages and car loans will drop. Even those borrowing at fixed rates will be able to save money by refinancing at lower costs. Consumption and investment will be more attractive as a result.

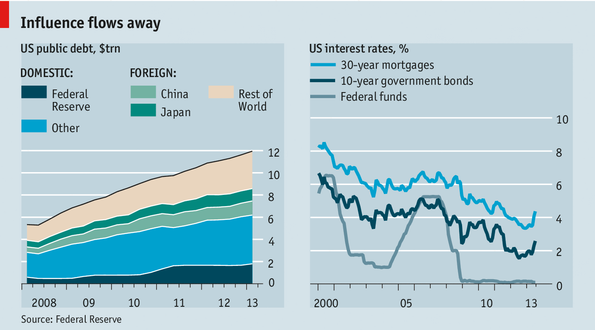

But both these tools have their problems. Start with asset purchases. At a combined $9.7 trillion, central banks in America, Britain, Japan and the euro area have big balance-sheets. But other investors have more heft in the markets central banks are trying to influence. Close to $5.6 trillion of Treasury securities are held by foreign investors, around half the supply. China and Japan together hold more than the Federal Reserve (see left-hand chart). In Britain a third of the £1.4 trillion debt stock is held by foreigners. They are active investors, buying over £250 billion since 2008.

These foreign purchases and sales can influence market rates. In the run-up to the crisis the Fed lifted its official rate, but yields on government bonds and mortgages did not rise by anything like as much (see right-hand chart). By tracking foreign capital flows, and controlling for other factors like lower inflation expectations, researchers have pinned part of this mismatch on the decisions of foreign investors. The consensus of a range of papers* is that the asset-allocation decisions of foreigners can raise or lower rates by up to 100 basis points. That can be enough to negate the actions of central banks. Foreign investors have sold $45 billion of Treasuries in 2013, nudging rates up when the Fed would prefer them to go down.

Influencing expectations is just as tricky. The difficulty is what Finn Kydland and Edward Prescott, in a 1977 paper, called the “time consistency” problem. The idea is that commitments about what central banks will do in future lack credibility if people think that policymakers will go back on their promises. The Bank of England has left itself lots of wiggle-room to raise rates if circumstances change, for example. Hollow pledges do not change the expectations of investors and shoppers.

Two tools are better than one

In both Britain and America interest rates are now rising—up by over 100 basis points since the start of May, despite asset purchases and interest-rate commitments. That suggests the new tools need to be sharpened. Stronger commitments would help. In a 2012 paper Michael Woodford of Columbia University argued that central bankers can use their reputations to get over the time-consistency problem. They should make an unconditional commitment to keep rates low until some objective threshold—an unemployment rate, say, or nominal GDP level—is hit. The embarrassment of having to backtrack would tie their hands, changing public expectations and triggering spending.

Another way to get more punch is to use the two new tools together, twinning asset purchases with strong forward guidance. In a 2013 paper Vasco Cúrdia and Andrea Ferrero of the Federal Reserve Bank of San Francisco investigated the impact of the $600 billion of asset purchases undertaken by the Fed in 2010-11. The researchers estimate that the policy, which was accompanied by forward guidance, added 0.13 percentage points to America’s growth rate. In normal times a speedier expansion is itself a signal that central banks are more likely to raise rates. This mix—lower rates today, but expectations of higher ones tomorrow—dampens the effect of asset purchases. Without the promise that rates would be held low into the future, the second round of quantitative easing (“QE2”) would have lost two-thirds of its potency, the researchers reckon, adding just 0.04 points to growth.

Perhaps the best example of this combination of strong words and deeds comes from the ECB. In July 2012 Mario Draghi, its president, announced it would do “whatever it takes” to ensure that the euro area survived. His pledge was backed by a new scheme to buy up debt issued by troubled governments. The promise was enough: interest rates in Spain fell by 250 basis points in the next year. And the commitment is still working, despite the fact that no debt has been bought yet. Central bankers may inhabit a new world, but they can still be as influential.

Sources

“Rules rather than discretion: The inconsistency of optimal plans”, by F. Kydland and E. Prescott, Journal of Political Economy, 1977

“Methods of Policy Accommodation at the Interest-Rate Lower Bound”, by Michael Woodford, Columbia University, 2012

“The Macroeconomic Effects of Large-Scale Asset Purchase Programs”, by Han Chen, Vasco Cúrdia and Andrea Ferrero, The Economic Journal, 2012

“How Stimulatory Are Large-Scale Asset Purchases?“, by Vasco Cúrdia and Andrea Ferrero, Federal Reserve Bank of San Francisco, Economic Letter, 2013

“Foreign Holdings of U.S. Treasuries and U.S. Treasury Yields”, by Daniel Beltran, Maxwell Kretchmer, Jaime Marquez, Charles Thomas, 2012

“International Capital Flows and U.S. Interest Rates", by Francis Warnock and Veronica Warnock, Journal of International Money and Finance, 2009

“Preferred-habitat investors and the US term structure of real rates”, by Iryna Kaminska, Dimitri Vayanos and Gabriele Zinna, Bank of England Working Papers, 2011

fecha |

Título |

23/09/2023| |

|

06/09/2022| |

|

17/09/2020| |

|

15/09/2020| |

|

18/08/2020| |

|

05/07/2020| |

|

01/06/2020| |

|

30/05/2020| |

|

15/05/2020| |

|

26/04/2020| |

|

14/04/2020| |

|

04/04/2020| |

|

24/03/2020| |

|

19/01/2020| |

|

23/08/2019| |

|

22/08/2019| |

|

20/08/2019| |

|

21/07/2019| |

|

04/02/2019| |

|

13/01/2019| |

|

26/12/2018| |

|

24/12/2018| |

|

04/10/2018| |

|

13/08/2018| |

|

12/08/2018| |

|

07/08/2018| |

|

03/08/2018| |

|

28/07/2018| |

|

25/07/2018| |

|

23/07/2018| |

|

23/07/2018| |

|

21/07/2018| |

|

01/07/2018| |

|

12/06/2018| |

|

26/04/2018| |

|

22/04/2018| |

|

10/04/2018| |

|

24/03/2018| |

|

20/03/2018| |

|

04/03/2018| |

|

03/02/2018| |

|

11/12/2017| |

|

11/12/2017| |

|

11/12/2017| |

|

02/12/2017| |

|

17/11/2017| |

|

16/11/2017| |

|

07/11/2017| |

|

01/11/2017| |

|

28/10/2017| |

|

26/10/2017| |

|

05/10/2017| |

|

26/09/2017| |

|

09/09/2017| |

|

20/08/2017| |

|

19/08/2017| |

|

14/08/2017| |

|

01/08/2017| |

|

22/07/2017| |

|

20/07/2017| |

|

15/07/2017| |

|

09/07/2017| |

|

07/07/2017| |

|

12/06/2017| |

|

10/06/2017| |

|

13/05/2017| |

|

13/05/2017| |

|

30/04/2017| |

|

19/04/2017| |

|

18/04/2017| |

|

04/04/2017| |

|

28/03/2017| |

|

28/03/2017| |

|

17/03/2017| |

|

12/03/2017| |

|

05/03/2017| |

|

05/03/2017| |

|

24/02/2017| |

|

24/02/2017| |

|

22/02/2017| |

|

22/02/2017| |

|

20/02/2017| |

|

01/02/2017| |

|

16/01/2017| |

|

16/01/2017| |

|

15/01/2017| |

|

10/01/2017| |

|

01/01/2017| |

|

24/11/2016| |

|

20/11/2016| |

|

11/11/2016| |

|

24/10/2016| |

|

17/10/2016| |

|

15/10/2016| |

|

14/10/2016| |

|

14/10/2016| |

|

13/10/2016| |

|

10/10/2016| |

|

01/10/2016| |

|

14/09/2016| |

|

09/09/2016| |

|

04/09/2016| |

|

04/09/2016| |

|

17/08/2016| |

|

14/08/2016| |

|

14/08/2016| |

|

16/06/2016| |

|

11/06/2016| |

|

06/06/2016| |

|

06/06/2016| |

|

27/05/2016| |

|

07/05/2016| |

|

14/04/2016| |

|

14/04/2016| |

|

11/04/2016| |

|

11/04/2016| |

|

25/03/2016| |

|

18/03/2016| |

|

18/03/2016| |

|

18/03/2016| |

|

15/03/2016| |

|

15/03/2016| |

|

13/03/2016| |

|

08/02/2016| |

|

07/02/2016| |

|

24/01/2016| |

|

05/01/2016| |

|

04/01/2016| |

|

31/12/2015| |

|

16/12/2015| |

|

16/12/2015| |

|

11/12/2015| |

|

28/11/2015| |

|

21/11/2015| |

|

10/11/2015| |

|

07/11/2015| |

|

03/11/2015| |

|

31/10/2015| |

|

19/10/2015| |

|

19/10/2015| |

|

15/10/2015| |

|

28/09/2015| |

|

20/09/2015| |

|

18/09/2015| |

|

03/09/2015| |

|

31/08/2015| |

|

28/08/2015| |

|

21/08/2015| |

|

16/08/2015| |

|

08/08/2015| |

|

08/08/2015| |

|

30/07/2015| |

|

30/07/2015| |

|

22/07/2015| |

|

27/06/2015| |

|

27/06/2015| |

|

17/06/2015| |

|

09/06/2015| |

|

06/06/2015| |

|

03/06/2015| |

|

30/05/2015| |

|

30/05/2015| |

|

22/05/2015| |

|

21/05/2015| |

|

19/05/2015| |

|

06/05/2015| |

|

02/05/2015| |

|

03/04/2015| |

|

31/03/2015| |

|

29/03/2015| |

|

09/03/2015| |

|

04/03/2015| |

|

25/02/2015| |

|

19/02/2015| |

|

16/02/2015| |

|

16/02/2015| |

|

01/02/2015| |

|

01/02/2015| |

|

27/01/2015| |

|

27/01/2015| |

|

27/01/2015| |

|

23/01/2015| |

|

22/01/2015| |

|

13/01/2015| |

|

13/01/2015| |

|

02/01/2015| |

|

02/01/2015| |

|

22/12/2014| |

|

21/12/2014| |

|

21/12/2014| |

|

18/12/2014| |

|

14/12/2014| |

|

04/12/2014| |

|

01/12/2014| |

|

01/12/2014| |

|

28/11/2014| |

|

20/11/2014| |

|

20/11/2014| |

|

12/11/2014| |

|

01/11/2014| |

|

21/10/2014| |

|

19/10/2014| |

|

18/10/2014| |

|

14/10/2014| |

|

12/10/2014| |

|

12/10/2014| |

|

12/10/2014| |

|

10/10/2014| |

|

06/10/2014| |

|

06/10/2014| |

|

01/10/2014| |

|

29/09/2014| |

|

29/09/2014| |

|

19/09/2014| |

|

15/09/2014| |

|

09/09/2014| |

|

01/09/2014| |

|

26/08/2014| |

|

26/08/2014| |

|

19/08/2014| |

|

19/08/2014| |

|

08/08/2014| |

|

29/07/2014| |

|

29/07/2014| |

|

27/07/2014| |

|

27/07/2014| |

|

21/07/2014| |

|

21/07/2014| |

|

21/07/2014| |

|

03/07/2014| |

|

01/07/2014| |

|

23/06/2014| |

|

21/06/2014| |

|

18/06/2014| |

|

18/06/2014| |

|

18/06/2014| |

|

29/05/2014| |

|

21/05/2014| |

|

17/05/2014| |

|

09/05/2014| |

|

09/05/2014| |

|

09/05/2014| |

|

05/05/2014| |

|

27/04/2014| |

|

20/04/2014| |

|

20/04/2014| |

|

20/04/2014| |

|

11/04/2014| |

|

07/04/2014| |

|

31/03/2014| |

|

31/03/2014| |

|

25/03/2014| |

|

04/03/2014| |

|

27/02/2014| |

|

21/02/2014| |

|

17/02/2014| |

|

14/02/2014| |

|

04/02/2014| |

|

31/01/2014| |

|

31/01/2014| |

|

25/01/2014| |

|

16/01/2014| |

|

15/01/2014| |

|

15/01/2014| |

|

14/01/2014| |

|

02/01/2014| |

|

25/12/2013| |

|

19/12/2013| |

|

11/12/2013| |

|

11/12/2013| |

|

06/12/2013| |

|

03/12/2013| |

|

03/12/2013| |

|

27/11/2013| |

|

25/11/2013| |

|

20/11/2013| |

|

17/11/2013| |

|

11/11/2013| |

|

08/11/2013| |

|

06/11/2013| |

|

05/11/2013| |

|

28/10/2013| |

|

28/10/2013| |

|

28/10/2013| |

|

27/10/2013| |

|

21/10/2013| |

|

21/10/2013| |

|

21/10/2013| |

|

16/10/2013| |

|

10/10/2013| |

|

09/10/2013| |

|

09/10/2013| |

|

29/09/2013| |

|

21/09/2013| |

|

17/09/2013| |

|

17/09/2013| |

|

15/09/2013| |

|

15/09/2013| |

|

14/09/2013| |

|

03/09/2013| |

|

27/08/2013| |

|

17/08/2013| |

|

12/08/2013| |

|

12/08/2013| |

|

12/08/2013| |

|

07/08/2013| |

|

29/07/2013| |

|

18/07/2013| |

|

18/07/2013| |

|

12/07/2013| |

|

12/07/2013| |

|

11/07/2013| |

|

07/07/2013| |

|

06/07/2013| |

|

29/06/2013| |

|

21/06/2013| |

|

21/06/2013| |

|

16/06/2013| |

|

16/06/2013| |

|

16/06/2013| |

|

12/06/2013| |

|

03/06/2013| |

|

03/06/2013| |

|

30/05/2013| |

|

30/05/2013| |

|

28/05/2013| |

|

28/05/2013| |

|

28/05/2013| |

|

23/05/2013| |

|

23/05/2013| |

|

20/05/2013| |

|

20/05/2013| |

|

16/05/2013| |

|

16/05/2013| |

|

10/05/2013| |

|

10/05/2013| |

|

06/05/2013| |

|

04/05/2013| |

|

23/04/2013| |

|

21/04/2013| |

|

21/04/2013| |

|

19/04/2013| |

|

14/04/2013| |

|

11/04/2013| |

|

08/04/2013| |

|

03/04/2013| |

|

31/03/2013| |

|

22/03/2013| |

|

21/03/2013| |

|

14/03/2013| |

|

14/03/2013| |

|

11/03/2013| |

|

11/03/2013| |

|

11/03/2013| |

|

03/03/2013| |

|

03/03/2013| |

|

03/03/2013| |

|

03/03/2013| |

|

03/03/2013| |

|

25/02/2013| |

|

25/02/2013| |

|

18/02/2013| |

|

18/02/2013| |

|

18/02/2013| |

|

14/02/2013| |

|

14/02/2013| |

|

11/02/2013| |

|

11/02/2013| |

|

11/02/2013| |

|

27/01/2013| |

|

25/01/2013| |

|

22/01/2013| |

|

22/01/2013| |

|

15/01/2013| |

|

13/01/2013| |

|

10/01/2013| |

|

10/01/2013| |

|

10/01/2013| |

|

09/01/2013| |

|

09/01/2013| |

|

30/12/2012| |

|

25/12/2012| |

|

25/12/2012| |

|

24/12/2012| |

|

24/12/2012| |

|

19/12/2012| |

|

18/12/2012| |

|

18/12/2012| |

|

12/12/2012| |

|

08/12/2012| |

|

06/12/2012| |

|

05/12/2012| |

|

04/12/2012| |

|

04/12/2012| |

|

27/11/2012| |

|

26/11/2012| |

|

24/11/2012| |

|

24/11/2012| |

|

24/11/2012| |

|

19/11/2012| |

|

18/11/2012| |

|

18/11/2012| |

|

18/11/2012| |

|

10/11/2012| |

|

09/11/2012| |

|

09/11/2012| |

|

09/11/2012| |

|

07/11/2012| |

|

07/11/2012| |

|

07/11/2012| |

|

07/11/2012| |

|

07/11/2012| |

|

07/11/2012| |

|

05/11/2012| |

|

02/11/2012| |

|

02/11/2012| |

|

01/11/2012| |

|

31/10/2012| |

|

31/10/2012| |

|

30/10/2012| |

|

30/10/2012| |

|

26/10/2012| |

|

26/10/2012| |

|

26/10/2012| |

|

26/10/2012| |

|

19/10/2012| |

|

19/10/2012| |

|

19/10/2012| |

|

19/10/2012| |

|

19/10/2012| |

|

29/09/2012| |

|

10/09/2012| |

|

10/09/2012| |

|

10/09/2012| |

|

10/09/2012| |

|

10/09/2012| |

|

09/09/2012| |

|

01/09/2012| |

|

01/09/2012| |

|

01/09/2012| |

|

30/08/2012| |

|

24/08/2012| |

|

22/08/2012| |

|

22/08/2012| |

|

22/08/2012| |

|

21/08/2012| |

|

15/08/2012| |

|

15/08/2012| |

|

15/08/2012| |

|

13/08/2012| |

|

13/08/2012| |

|

10/08/2012| |

|

09/08/2012| |

|

09/08/2012| |

|

07/08/2012| |

|

06/08/2012| |

|

06/08/2012| |

|

06/08/2012| |

|

06/08/2012| |

|

31/07/2012| |

|

31/07/2012| |

|

31/07/2012| |

|

31/07/2012| |

|

28/07/2012| |

|

28/07/2012| |

|

28/07/2012| |

|

28/07/2012| |

|

28/07/2012| |

|

28/07/2012| |

|

28/07/2012| |

|

28/07/2012| |

|

25/07/2012| |

|

25/07/2012| |

|

15/07/2012| |

|

15/07/2012| |

|

14/07/2012| |

|

10/07/2012| |

|

10/07/2012| |

|

09/07/2012| |

|

14/06/2012| |

|

14/06/2012| |

|

09/06/2012| |

|

09/06/2012| |

|

09/06/2012| |

|

08/06/2012| |

|

04/06/2012| |

|

04/06/2012| |

|

03/06/2012| |

|

03/06/2012| |

|

21/05/2012| |

|

20/05/2012| |

|

20/05/2012| |

|

06/05/2012| |

|

27/04/2012| |

|

13/04/2012| |

|

13/04/2012| |

|

13/04/2012| |

|

12/04/2012| |

|

12/04/2012| |

|

07/04/2012| |

|

07/04/2012| |

|

06/04/2012| |

|

06/04/2012| |

|

04/04/2012| |

|

01/04/2012| |

|

01/04/2012| |

|

01/04/2012| |

|

19/03/2012| |

|

19/03/2012| |

|

18/03/2012| |

|

18/03/2012| |

|

12/03/2012| |

|

12/03/2012| |

|

04/03/2012| |

|

04/03/2012| |

|

04/03/2012| |

|

04/03/2012| |

|

04/03/2012| |

|

04/03/2012| |

|

04/03/2012| |

|

04/03/2012| |

|

02/03/2012| |

|

02/03/2012| |

|

02/03/2012| |

|

25/02/2012| |

|

25/02/2012| |

|

25/02/2012| |

|

25/02/2012| |

|

25/02/2012| |

|

25/02/2012| |

|

05/11/2011| |

|

30/10/2011| |

|

30/10/2011| |

|

29/10/2011| |

|

21/10/2011| |

|

11/10/2011| |

|

11/10/2011| |

|

08/10/2011| |

|

04/10/2011| |

|

03/10/2011| |

|

03/10/2011| |

|

03/10/2011| |

|

01/10/2011| |

|

01/10/2011| |

|

25/09/2011| |

|

24/09/2011| |

|

23/09/2011| |

|

23/09/2011| |

|

23/09/2011| |

|

23/09/2011| |

|

23/09/2011| |

|

20/09/2011| |

|

17/09/2011| |

|

17/09/2011| |

|

16/09/2011| |

|

15/09/2011| |

|

11/09/2011| |

|

11/09/2011| |

|

07/09/2011| |

|

07/09/2011| |

|

04/09/2011| |

|

04/09/2011| |

|

04/09/2011| |

|

04/09/2011| |

|

02/09/2011| |

|

02/09/2011| |

|

02/09/2011| |

|

02/09/2011| |

|

27/08/2011| |

|

27/08/2011| |

|

27/08/2011| |

|

27/08/2011| |

|

26/08/2011| |

|

26/08/2011| |

|

26/08/2011| |

|

26/08/2011| |

|

25/08/2011| |

|

25/08/2011| |

|

23/08/2011| |

|

23/08/2011| |

|

16/08/2011| |

|

16/08/2011| |

|

16/08/2011| |

|

16/08/2011| |

|

11/08/2011| |

|

11/08/2011| |

|

11/08/2011| |

|

07/08/2011| |

|

04/08/2011| |

|

29/07/2011| |

|

28/07/2011| |

|

24/07/2011| |

|

24/07/2011| |

|

23/07/2011| |

|

23/07/2011| |

|

22/07/2011| |

|

21/07/2011| |

|

21/07/2011| |

|

17/07/2011| |

|

17/07/2011| |

|

15/07/2011| |

|

15/07/2011| |

|

15/07/2011| |

|

15/07/2011| |

|

13/07/2011| |

|

13/07/2011| |

|

13/07/2011| |

|

13/07/2011| |

|

29/06/2011| |

|

29/06/2011| |

|

19/06/2011| |

|

19/06/2011| |

|

19/06/2011| |

|

19/06/2011| |

|

18/06/2011| |

|

18/06/2011| |

|

18/06/2011| |

|

18/06/2011| |

|

17/06/2011| |

|

17/06/2011| |

|

14/06/2011| |

|

14/06/2011| |

|

13/06/2011| |

|

13/06/2011| |

|

13/06/2011| |

|

13/06/2011| |

|

05/06/2011| |

|

05/06/2011| |

|

03/06/2011| |

|

03/06/2011| |

|

03/06/2011| |

|

03/06/2011| |

|

01/06/2011| |

|

01/06/2011| |

|

01/06/2011| |

|

01/06/2011| |

|

01/06/2011| |

|

01/06/2011| |

|

01/06/2011| |

|

01/06/2011| |

|

29/05/2011| |

|

29/05/2011| |

|

29/05/2011| |

|

29/05/2011| |

|

29/05/2011| |

|

29/05/2011| |

|

23/05/2011| |

|

23/05/2011| |

|

22/05/2011| |

|

22/05/2011| |

|

22/05/2011| |

|

22/05/2011| |

|

22/05/2011| |

|

22/05/2011| |

|

21/05/2011| |

|

21/05/2011| |

|

21/05/2011| |

|

21/05/2011| |

|

16/05/2011| |

|

16/05/2011| |

|

13/05/2011| |

|

13/05/2011| |

|

06/05/2011| |

|

06/05/2011| |

|

04/05/2011| |

|

04/05/2011| |

|

04/05/2011| |

|

04/05/2011| |

|

02/05/2011| |

|

02/05/2011| |

|

02/05/2011| |

|

02/05/2011| |

|

01/05/2011| |

|

01/05/2011| |

|

01/05/2011| |

|

01/05/2011| |

|

01/05/2011| |

|

01/05/2011| |

|

26/04/2011| |

|

26/04/2011| |

|

26/04/2011| |

|

26/04/2011| |

|

26/04/2011| |

|

26/04/2011| |

|

21/04/2011| |

|

21/04/2011| |

|

21/04/2011| |

|

21/04/2011| |

|

20/04/2011| |

|

20/04/2011| |

|

20/04/2011| |

|

20/04/2011| |

|

20/04/2011| |

|

20/04/2011| |

|

15/04/2011| |

|

11/04/2011| |

|

11/04/2011| |

|

08/04/2011| |

|

03/04/2011| |

|

27/03/2011| |

|

27/03/2011| |

|

26/03/2011| |

|

26/03/2011| |

|

20/03/2011| |

|

20/03/2011| |

|

19/03/2011| |

|

19/03/2011| |

|

19/03/2011| |

|

13/03/2011| |

|

13/03/2011| |

|

12/03/2011| |

|

11/03/2011| |

|

11/03/2011| |

|

09/03/2011| |

|

07/03/2011| |

|

07/03/2011| |

|

05/03/2011| |

|

04/03/2011| |

|

04/03/2011| |

|

04/03/2011| |

|

18/02/2011| |

|

21/01/2011| |

|

21/01/2011| |

|

16/01/2011| |

|

16/01/2011| |

|

11/01/2011| |

|

08/01/2011| |

|

02/01/2011| |

|

02/01/2011| |

|

29/12/2010| |

|

29/12/2010| |

|

28/12/2010| |

|

26/12/2010| |

|

13/12/2010| |

|

13/12/2010| |

|

08/12/2010| |

|

02/12/2010| |

|

30/11/2010| |

|

30/11/2010| |

|

28/11/2010| |

|

26/11/2010| |

|

26/11/2010| |

|

24/11/2010| |

|

16/11/2010| |

|

16/11/2010| |

|

16/11/2010| |

|

09/11/2010| |

|

07/11/2010| |

|

31/10/2010| |

|

31/10/2010| |

|

31/10/2010| |

|

26/10/2010| |

|

25/10/2010| |

|

22/10/2010| |

|

18/10/2010| |

|

16/10/2010| |

|

16/10/2010| |

|

11/10/2010| |

|

10/10/2010| |

|

10/10/2010| |

|

09/10/2010| |

|

05/10/2010| |

|

28/09/2010| |

|

28/09/2010| |

|

24/09/2010| |

|

24/09/2010| |

|

22/09/2010| |

|

22/09/2010| |

|

15/09/2010| |

|

15/09/2010| |

|

15/09/2010| |

|

12/09/2010| |

|

12/09/2010| |

|

12/09/2010| |

|

12/09/2010| |

|

06/09/2010| |

|

06/09/2010| |

|

05/09/2010| |

|

05/09/2010| |

|

29/08/2010| |

|

29/08/2010| |

|

29/08/2010| |

|

29/08/2010| |

|

22/08/2010| |

|

22/08/2010| |

|

21/08/2010| |

|

21/08/2010| |

|

21/08/2010| |

|

21/08/2010| |

|

21/08/2010| |

|

21/08/2010| |

|

14/08/2010| |

|

13/08/2010| |

|

13/08/2010| |

|

07/08/2010| |

|

07/08/2010| |

|

12/07/2010| |

|

12/06/2010| |

|

12/06/2010| |

|

12/06/2010| |

|

24/05/2010| |

|

24/05/2010| |

|

11/05/2010| |

|

10/05/2010| |

|

09/05/2010| |

|

09/05/2010| |

|

09/05/2010| |

|

01/04/2010| |

|

01/04/2010| |

|

31/03/2010| |

|

31/03/2010| |

|

31/03/2010| |

|

28/03/2010| |

|

28/03/2010| |

|

28/03/2010| |

|

20/03/2010| |

|

12/03/2010| |

|

12/03/2010| |

|

12/03/2010| |

|

08/03/2010| |

|

07/03/2010| |

|

06/03/2010| |

|

05/03/2010| |

|

03/03/2010| |

|

03/03/2010| |

|

28/02/2010| |

|

21/02/2010| |

|

19/02/2010| |

|

14/02/2010| |

|

11/02/2010| |

|

11/02/2010| |

|

10/02/2010| |

|

08/02/2010| |

|

08/02/2010| |

|

08/02/2010| |

|

28/01/2010| |

|

25/01/2010| |

|

20/01/2010| |

|

20/01/2010| |

|

16/01/2010| |

|

16/01/2010| |

|

15/01/2010| |

|

15/01/2010| |

|

11/01/2010| |

|

11/01/2010| |

|

10/01/2010| |

|

07/01/2010| |

|

03/01/2010| |

|

03/01/2010| |

|

03/01/2010| |

|

17/12/2009| |

|

15/12/2009| |

|

15/12/2009| |

|

13/12/2009| |

|

13/12/2009| |

|

28/11/2009| |

|

28/11/2009| |

|

28/11/2009| |

|

28/11/2009| |

|

27/11/2009| |

|

27/11/2009| |

|

27/11/2009| |

|

27/11/2009| |

|

27/11/2009| |

|

27/11/2009| |

|

21/11/2009| |

|

21/11/2009| |

|

18/11/2009| |

|

18/11/2009| |

|

16/11/2009| |

|

16/11/2009| |

|

30/10/2009| |

|

30/10/2009| |

|

11/10/2009| |

|

10/10/2009| |

|

10/10/2009| |

|

07/10/2009| |

|

07/10/2009| |

|

04/10/2009| |

|

30/09/2009| |

|

30/09/2009| |

|

27/09/2009| |

|

27/09/2009| |

|

27/09/2009| |

|

22/09/2009| |

|

20/09/2009| |

|

18/09/2009| |

|

18/09/2009| |

|

18/09/2009| |

|

16/09/2009| |

|

16/09/2009| |

|

16/09/2009| |

|

08/09/2009| |

|

07/09/2009| |

|

06/09/2009| |

|

06/09/2009| |

|

05/09/2009| |

|

05/09/2009| |

|

26/08/2009| |

|

21/08/2009| |

|

19/08/2009| |

|

19/08/2009| |

|

15/08/2009| |

|

15/08/2009| |

|

15/08/2009| |

|

11/08/2009| |

|

11/08/2009| |

|

11/08/2009| |

|

11/08/2009| |

|

19/07/2009| |

|

19/07/2009| |

|

18/07/2009| |

|

18/07/2009| |

|

27/03/2009| |

|

22/03/2009| |

|

22/03/2009| |

|

27/01/2009| |

|

27/01/2009| |

|

27/01/2009| |

|

17/01/2009| |

|

17/01/2009| |

|

17/01/2009| |

|

17/01/2009| |

|

17/01/2009| |

|

17/01/2009| |

|

11/01/2009| |

|

06/12/2008| |

|

06/12/2008| |

|

06/12/2008| |

|

06/12/2008| |

|

23/11/2008| |

|

23/11/2008| |

|

16/11/2008| |

|

16/11/2008| |

|

04/11/2008| |

|

04/11/2008| |

|

03/11/2008| |

|

03/11/2008| |

|

24/10/2008| |

|

24/10/2008| |

|

24/10/2008| |

|

24/10/2008| |

|

15/09/2008| |

|

15/09/2008| |

|

15/09/2008| |

|

15/09/2008| |

|

15/09/2008| |

|

15/09/2008| |

|

06/09/2008| |

|

06/09/2008| |

|

05/09/2008| |

|

05/09/2008| |

|

05/09/2008| |

|

05/09/2008| |

|

01/09/2008| |

|

01/09/2008| |

|

01/09/2008| |

|

01/09/2008| |

|

22/08/2008| |

|

22/08/2008| |

|

17/08/2008| |

|

17/08/2008| |

|

16/08/2008| |

|

16/08/2008| |

|

28/07/2008| |

|

28/07/2008| |

|

28/07/2008| |

|

28/07/2008| |

|

28/07/2008| |

|

28/07/2008| |

|

19/07/2008| |

|

19/07/2008| |

|

24/05/2008| |

|

24/05/2008| |

|

03/05/2008| |

|

03/05/2008| |

|

29/04/2008| |

|

11/02/2008| |

|

05/01/2008| |

|

09/12/2007| |

|

18/11/2007| |

|

10/11/2007| |

|

10/11/2007| |

|

06/11/2007| |

|

06/11/2007| |

|

06/09/2007| |

|

26/08/2007| |

|

25/08/2007| |

|

11/07/2007| |

|

16/06/2007| |

|

16/06/2007| |

|

10/06/2007| |

|

10/06/2007| |

|

19/05/2007| |

|

19/05/2007| |

|

19/05/2007| |

|

19/05/2007| |

|

24/04/2007| |

|

24/04/2007| |

|

14/04/2007| |

|

14/04/2007| |

|

05/04/2007| |

|

05/04/2007| |

|

05/04/2007| |

|

28/02/2007| |

|

28/02/2007| |

|

05/02/2007| |

|

05/02/2007| |

|

04/02/2007| |

|

04/02/2007| |

|

04/02/2007| |

|

04/02/2007| |

|

04/02/2007| |

|

04/02/2007| |

|

29/01/2007| |

|

29/01/2007| |

|

29/01/2007| |

|

29/01/2007| |

|

11/01/2007| |

|

11/01/2007| |

|

11/01/2007| |

|

11/01/2007| |

|

27/12/2006| |

|

27/12/2006| |

|

27/12/2006| |

|

27/12/2006| |

|

27/12/2006| |

|

27/12/2006| |

|

20/12/2006| |

|

20/12/2006| |

|

17/11/2006| |

|

30/09/2006| |

|

28/07/2006| |

|

12/04/2006| |

|

12/04/2006| |

|

12/04/2006| |

|

06/03/2006| |

|

21/02/2006| |

|

17/02/2006| |

|

31/01/2006| |

|

10/01/2006| |

|

28/12/2005| |

|

31/10/2005| |

|

26/09/2005| |

|

29/08/2005| |

|

11/08/2005| |

|

08/08/2005| |

|

24/06/2005| |

|

24/06/2005| |

|

24/06/2005| |

|

03/04/2005| |

|

03/04/2005| |

|

03/04/2005| |

|

03/04/2005| |

|